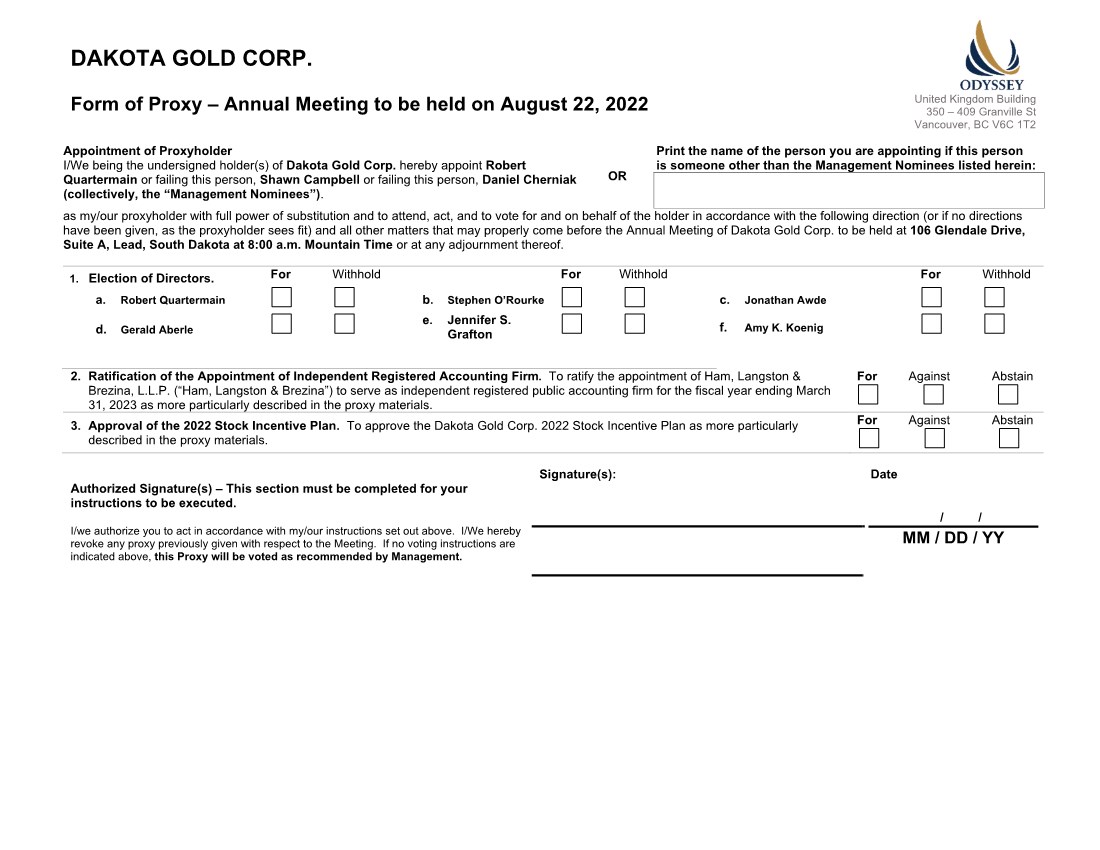

You are entitled to attend and vote at the annual meeting, or any postponement or adjournment of the annual meeting, if you are a holder of our common stock at the close of business on July 12, 2022.March 25, 2024. This Proxy Statement, proxy card and Annual Report to Stockholders, including financial statements for the fiscal year ended MarchDecember 31, 2022,2023, are first being sent to stockholders on or around July 25, 2022.April 3, 2024.

This Proxy Statement is furnished to the stockholders of Dakota Gold Corp. (“Dakota Gold,” the “Company,” “we” or “our”) in connection with the solicitation of proxies by the board of directors of Dakota Gold Corp. (the “Board of Directors”) of Dakota Gold Corp. to be voted at the annual meeting of stockholders on August 22, 2022,May 14, 2024, or at any postponements or adjournments of the annual meeting. Our annual meeting is being held for the purposes set forth in the accompanying Notice of 20222024 Annual Meeting of Stockholders. The Proxy Statement, proxy card and Annual Report to Stockholders, including financial statements for the fiscal year period ended MarchDecember 31, 2022,2023, were first made available to stockholders on or about July 25, 2022.April 3, 2024.

At our annual meeting, stockholders will vote on the following three items of business:

Stockholders will also vote on such other matters as may properly come before the annual meeting or any postponement or adjournment thereof.

Most stockholders hold their shares through a broker or other holder of record rather than directly in their own names. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

No action is proposed at this meeting for which the laws of the state of Nevada or our Bylawsamended and restated bylaws (the “Bylaws”) provide a right of our stockholders to dissent and obtain appraisal of or payment for such stockholders’ common stock.

Votes will be tabulated by Odyssey Trust Company. We do not expect any matters to be presented for a vote at the annual meeting other than the matters described in this Proxy Statement. If you grant a proxy, any of the officers named as proxy holder, Robert Quartermain, Patrick Malone, Shawn Campbell Daniel Cherniak or their nominee(s) or substitute(s), will have the discretion to vote your shares on any additional matters that are properly presented for a vote at the annual meeting. If a nominee is not available as a candidate for director, any of the officers named as proxy holder will vote your proxy for another candidate nominated by our boardBoard of directors.Directors.

Proxies submitted properly will be voted in accordance with the instructions contained therein. If you submit a proxy but do not provide voting directions, the proxy will be voted “FOR” each of the six director nominees, “FOR” the ratification of the appointment of Ham, Langston & Brezina, L.L.P. as our independent registered public accounting firm, “FOR” the approval of the Dakota Gold 2022 Stock Incentive Plan, voted:

and in such manner as the proxy holders named on the proxy determine, in their discretion, upon such other business as may properly come before the annual meeting or any adjournment or postponement thereof.

If your shares are held through a broker, bank or other nominee (collectively referred to as “brokers”), the broker will vote your shares according to the specific instructions it receives from you. If the broker does not receive voting instructions from you, the broker may vote only on proposals that are considered “routine” matters. Under applicable NYSE rules and guidance, at this year’s annual meeting, your broker may vote without your instructions only on Proposal 2 (the ratification of the appointment of Ham, LangstonErnst & Brezina, L.L.P.Young LLP as our independent registered public accounting firm for the fiscal year ending MarchDecember 31, 2023)2024). The broker’s failure to vote on Proposal 1 (the election of directors) and Proposal 3 (the approval(reincorporation of the Dakota Gold 2022 Stock Incentive Plan),Company from Nevada to Delaware) because the broker lacks discretionary authority to do so is commonly referred to as a “broker non-vote”, will not affect the outcome of the vote on that matter..

After you have submitted your proxy, you may change the votes you cast or revoke your proxy at any time before the votes are cast at the annual meeting by:

In addition, the powers of the proxy holders to vote your stock will be suspended if you attend the annual meeting and so request, although attendance at the annual meeting will not by itself revoke a previously granted proxy.

The following table sets forth the name, age, and current positions of each nominee:

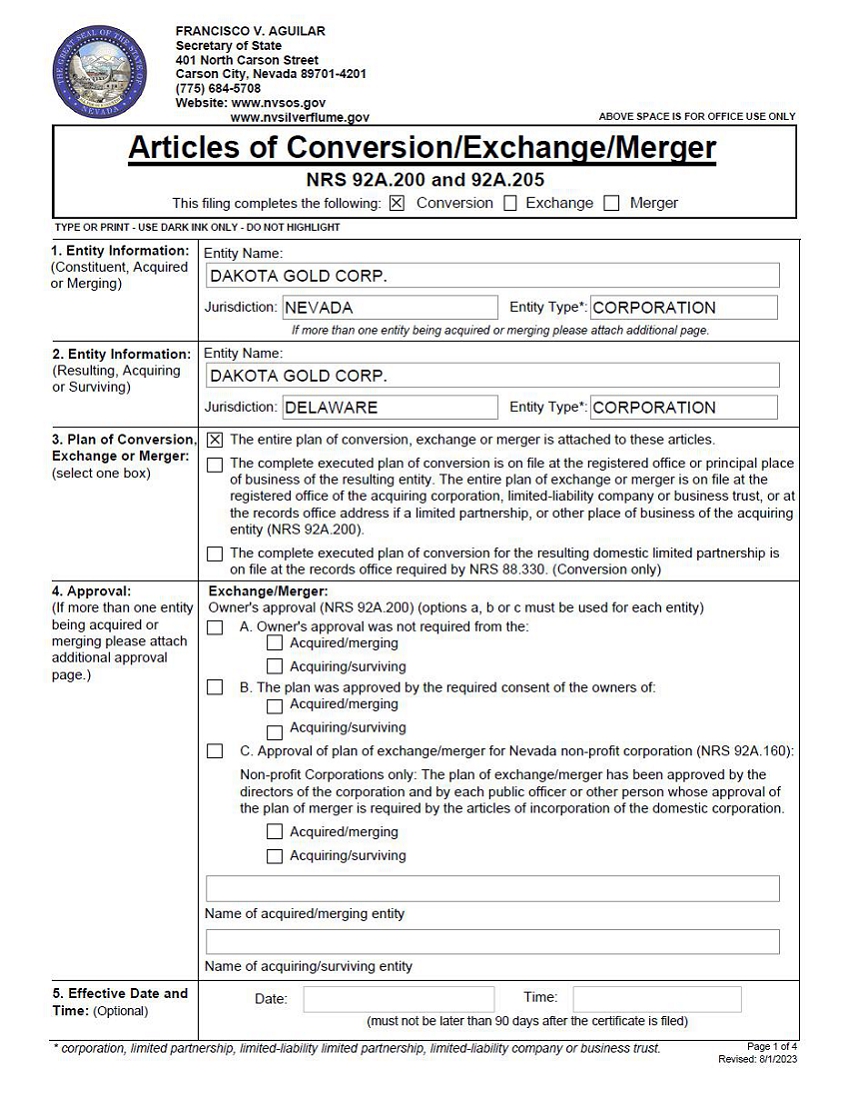

PROPOSAL 3 reincorporation from Nevada TO DELAWARE |

The Board of Directors unanimously recommends that the Company’s stockholders vote FOR the proposal to reincorporate the Company from the State of Nevada to the State of Delaware.

Our Board of Directors has approved and recommends to the stockholders a proposal to change the Company’s state of incorporation from the State of Nevada to the State of Delaware (the “Reincorporation”). If our stockholders approve the proposal, we will effect the Reincorporation by converting the corporation as provided in the Delaware General Corporation Law (the “DGCL”) and the Nevada Revised Statutes (the “NRS”).

Reasons for the Reincorporation

Our Board of Directors believes that there are a number of reasons why Delaware is an attractive state for the incorporation of the Company and why reincorporating is in the best interests of our stockholders. For many years, Delaware has followed a policy of encouraging incorporation in that state. To advance that policy, Delaware has adopted comprehensive, modern and flexible corporate laws that are updated and revised periodically to meet changing business needs. As a result, many major corporations have initially chosen Delaware for their domicile or have subsequently reincorporated in Delaware. Delaware courts have developed considerable expertise in dealing with corporate issues. In doing so, Delaware courts have created a substantial body of case law construing Delaware law and establishing public policies with respect to Delaware corporations. Our Board of Directors believes that this environment provides greater predictability with respect to corporate legal affairs and allows a corporation to be managed more efficiently.

In contrast, Nevada case law concerning the effects of its statutes and regulations is more limited, resulting in less predictability with respect to legality of corporate affairs and transactions and stockholders’ rights to challenge them. The Company believes that investors are familiar with Delaware law and generally comfortable with the degree of certainty that Delaware jurisprudence provides, which may help attract investors and potentially bolster trading in the Company’s Common Stock.

As discussed below under “Certain Effects of the Change in State of Incorporation,” there are differences in Delaware Law and Nevada Law that may affect the rights of stockholders.

The Plan of Conversion

To accomplish the reincorporation, the Board of Directors has adopted a plan of conversion (the “Plan of Conversion”), substantially in the form attached hereto as Appendix A. The Plan of Conversion provides that we will convert into a Delaware corporation and thereafter will be subject to the DGCL.

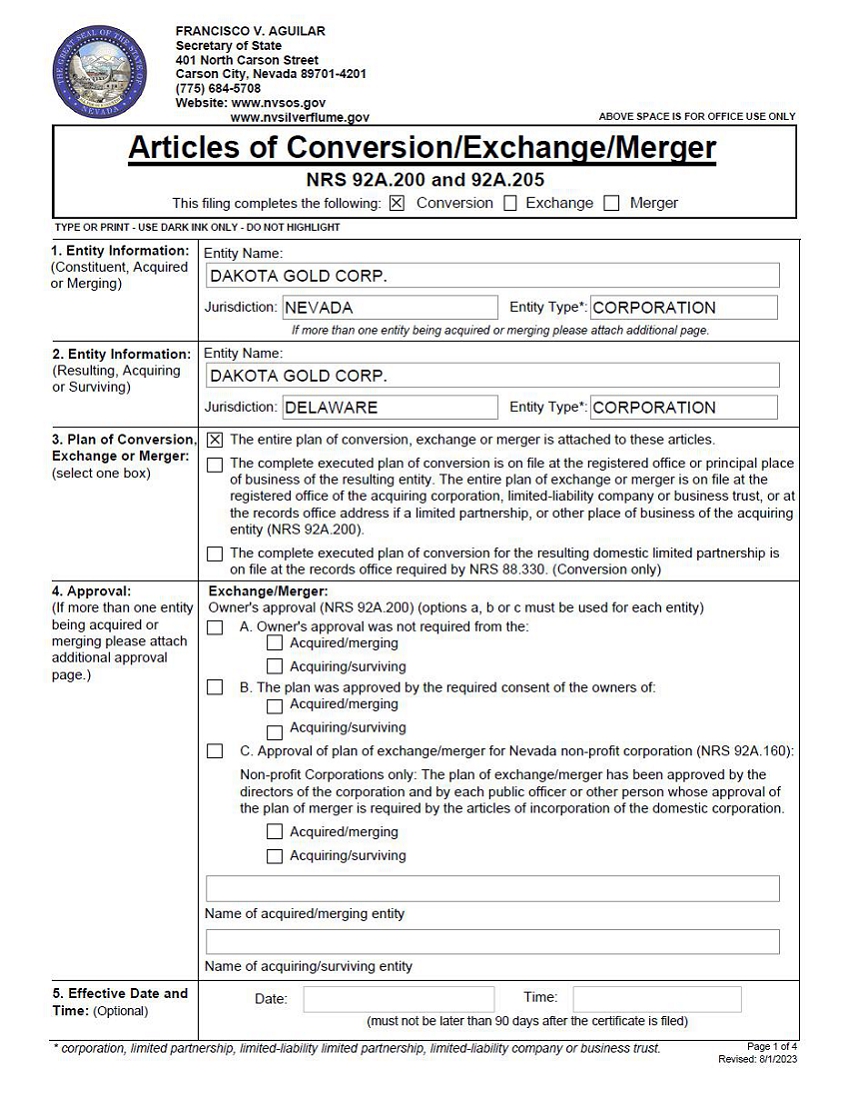

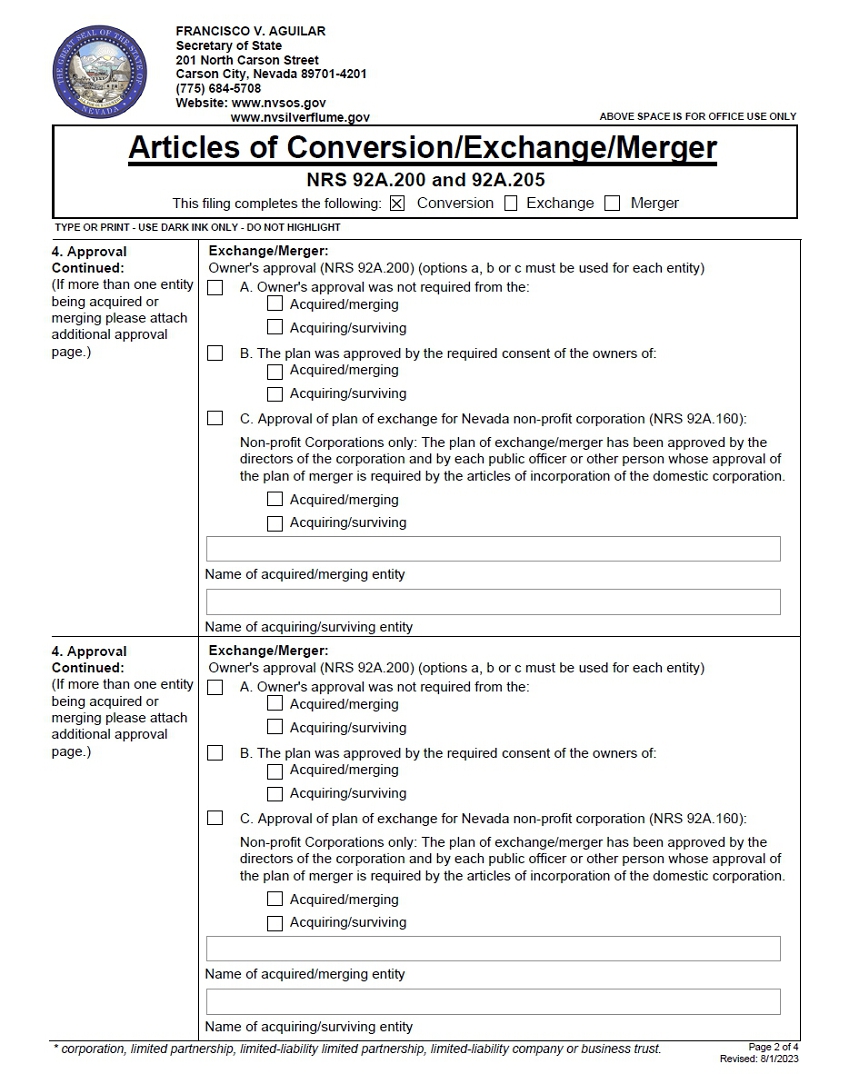

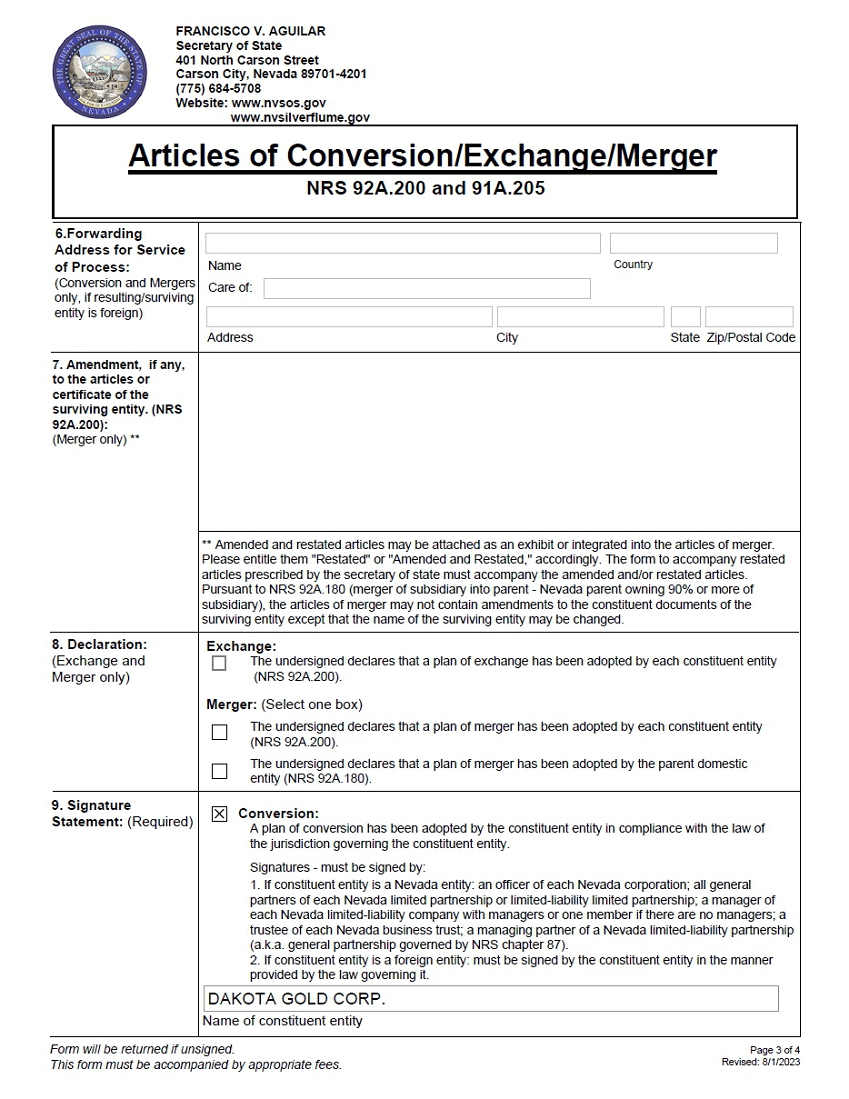

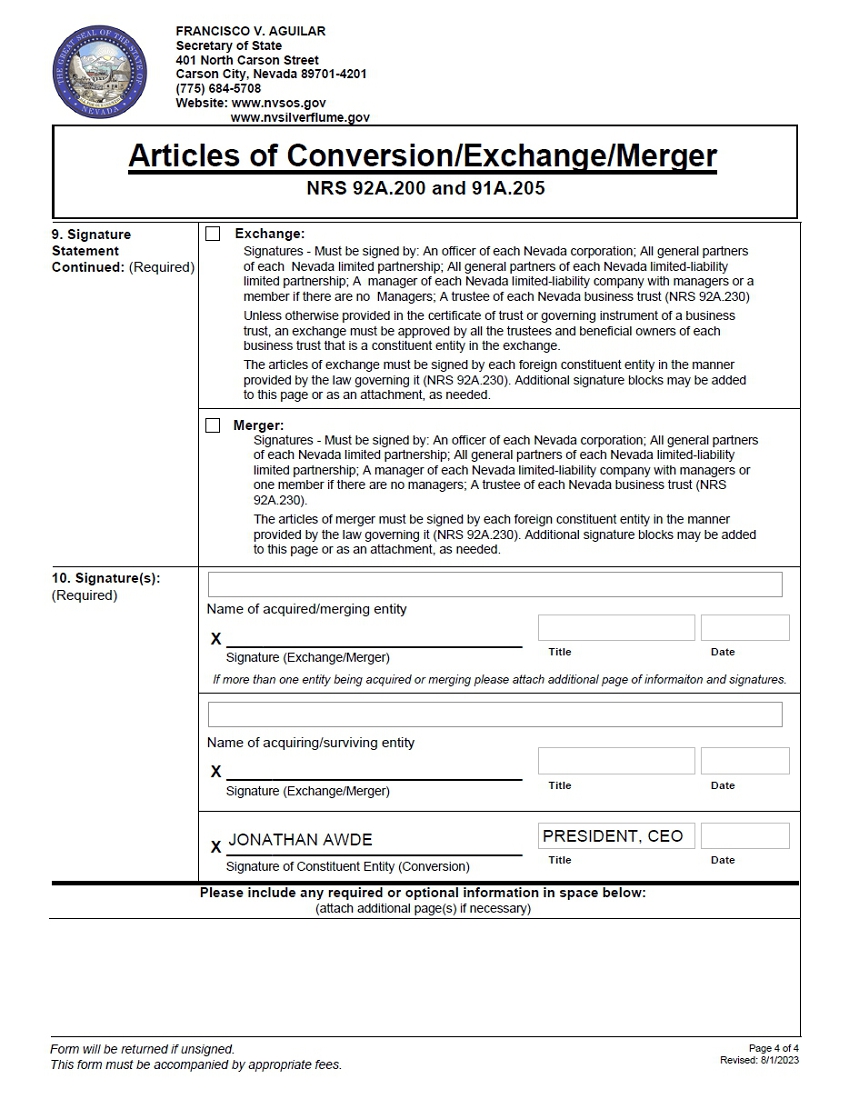

Assuming the holders of a majority of our outstanding shares of common stock vote in favor of this Proposal 3, we will cause the Reincorporation to be effected at such time as we determine by filing with (1) the Secretary of State of the State of Nevada articles of conversion, substantially in the form attached hereto as Appendix B (the “Articles of Conversion”) and (2) the Secretary of State of the State of Delaware (i) the certificate of conversion, substantially in the form attached hereto as Appendix C (the “Delaware Certificate of Conversion”) and (ii) the Certificate of Incorporation, substantially in the form attached hereto as Appendix D (the “Delaware Certificate of Incorporation”). In addition, if and when the Board of Directors effects the Reincorporation, the Board of Directors will adopt the Bylaws of Dakota Gold Corp. substantially in the form attached hereto as Appendix E (the “Delaware Bylaws”). Approval of this Proposal 3 by our stockholders will constitute approval of the Plan of Conversion, the Articles of Conversion, the Delaware Certificate of Conversion, the Delaware Certificate of Incorporation, and the Delaware Bylaws.

The Reincorporation will be effected pursuant to the Plan of Conversion. The Plan of Conversion provides that the Company will convert into a Delaware corporation, which will continue with all of the assets, rights, privileges and powers of the Company, and all property owned by the Company, all debts due to the Company, as well as all other causes of action belonging to the Company immediately prior to the conversion, remaining vested in Dakota Gold Corp., a Delaware corporation (“Reincorporated Dakota Gold”) following the conversion. The Company will remain as the same entity following the Reincorporation. The directors and officers of the Company immediately prior to the conversion will be the directors and officers of Reincorporated Dakota Gold.

After the Reincorporation, the Delaware Certificate of Incorporation and Delaware Bylaws will be the governing instruments of Reincorporated Dakota Gold, resulting in some changes from the current amended and restated articles of incorporation of the Company (the “Articles of Incorporation”) and Bylaws, such as a change in the registered office and agent of the Company from an office and agent in Nevada to an office and agent in Delaware.

Effect of Vote for the Reincorporation

A vote in favor of the Reincorporation proposal is a vote to approve the Plan of Conversion and therefore the Reincorporation. A vote in favor of the Reincorporation proposal is also effectively a vote in favor of the Delaware Certificate of Incorporation and Delaware Bylaws.

If the Reincorporation proposal fails to obtain the requisite vote for approval, the Reincorporation will not be consummated and the Company will continue to be incorporated in Nevada and be subject to the Company’s existing Articles of Incorporation and Bylaws.

Effective Time

If the Reincorporation proposal is approved, the Reincorporation will become effective upon the filing of, and at the date and time specified in (as applicable), the Delaware Certificate of Conversion and Delaware Certificate of Incorporation filed with the Secretary of State of Delaware and the Nevada Articles of Conversion are filed with the Secretary of State of Nevada, in each case, upon acceptance thereof by the Delaware Secretary of State and the Nevada Secretary of State, respectively. If the Reincorporation proposal is approved, it is anticipated that our Board of Directors will cause the Reincorporation to be effected as soon as reasonably practicable. However, the Reincorporation may be delayed by the Board of Directors or the Reincorporation may be terminated and abandoned by action of the Board of Directors at any time prior to the effective time of the Reincorporation, whether before or after the approval by the Company’s stockholders, if the Board of Directors determines for any reason that the consummation of the Reincorporation should be delayed or would be inadvisable or not in the best interests of the Company and its stockholders, as the case may be.

Certain Effects of the Reincorporation

The Reincorporation will effect a change in our legal domicile; however, it will not result in any change in headquarters, business, jobs, management, location of any of offices or facilities, number of employees, assets, liabilities or net worth (other than as a result of the costs incident to reincorporating, which are immaterial). Management, including the directors and officers, will remain the same in connection with reincorporating. There will be no substantive change in the employment agreements for executive officers or in other direct or indirect interests of the current directors or executive officers as a result of reincorporating. Upon the effective time of the Reincorporation, each share of our common stock outstanding immediately prior to such effective time, by virtue of reincorporating and without any action on the part of the holder thereof, be converted into one fully paid and non-assessable share of common stock of Dakota Gold Corp., a Delaware corporation.

The following chart summarizes some of the material differences between the DGCL and the NRS. This chart does not address each difference between Delaware law and Nevada law but focuses on some of those differences which the Company believes are most relevant to the existing stockholders. This chart is not intended as an exhaustive list of all differences and is qualified in its entirety by reference to the DGCL and the NRS.

| Delaware | | Nevada |

| Removal of Directors | | |

| | |

| Unless otherwise provided in the certificate of incorporation, the DGCL permits the holders of a majority of shares of a corporation without a classified board then entitled to vote in an election of directors, to remove directors, with or without cause. | | Unless otherwise provided in the articles of incorporation, the NRS provides that any one or all of the directors of a corporation may be removed by the holders of not less than two-thirds of the voting power of a corporation’s issued and outstanding stock, with or without cause. |

| | |

| Number of Directors | | |

| | |

| Delaware law provides that a corporation must have at least one director and that the number of directors shall be fixed by or in the manner provided in the bylaws unless the certificate of incorporation fixes the number of directors. If that is the case, then the number of directors can only be changed by amending the certificate of incorporation. | | Nevada law provides that a corporation must have at least one director and may provide in its articles of incorporation or in its bylaws for a fixed number of directors or a variable number, and for the manner in which the number of directors may be increased or decreased. |

| | |

| Dividends and Other Distributions | | |

| | |

Delaware law permits the directors of a corporation, subject to any restrictions contained in its certificate of incorporation, to declare and pay dividends upon the shares of its capital stock, either (1) out of its surplus, as computed in accordance with the DGCL, or (2) in case there is no surplus, out of its net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year. However, such dividends cannot be declared out of net profits if the capital of the corporation, has diminished by depreciation in the value of its property, or by losses or otherwise, to an amount less than the aggregate amount of the capital represented by the issued and outstanding stock of all classes having a preference upon the distribution of assets. PROPOSAL 3Additionally, the DGCL also imposes on any director under whose administration distributions are declared in violation of the foregoing provision, personal liability to a corporation’s creditors in the event of its dissolution or insolvency, up to the full amount of the unlawful distribution, for a period of 6 years following a dividend declaration, unless such director’s dissent was recorded in the minutes of the proceedings approving the distribution.

| | Nevada law prohibits distributions to stockholders when the distributions would (i) render the corporation unable to pay its debts as they become due in the usual course of business and (ii) render the corporation’s total assets less than the sum of its total liabilities plus the amount that would be needed to satisfy the preferential rights upon dissolution of stockholders whose preferential rights are superior to those receiving the distribution. ApprovalAdditionally, the NRS imposes personal liability on any director under whose administration distributions are declared in violation of the 2022 Stock Incentive Planforegoing provision to a corporation’s creditors in the event of its dissolution or insolvency, up to the full amount of the unlawful distribution, for a period of 3 years following a dividend declaration, unless such director’s dissent was recorded in the minutes of the proceedings approving the distribution.

|

| Limitation of Liability | | |

| | |

A Delaware corporation is permitted to adopt provisions in its certificate of incorporation limiting or eliminating the liability of a director to a company and its stockholders for monetary damages for breach of fiduciary duty as a director, provided that such liability does not arise from certain proscribed conduct, including breach of the duty of loyalty, acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law or liability to the corporation based on unlawful dividends or distributions or improper personal benefit. The boardDelaware Certificate of Incorporation includes such a provision. | | Under Nevada law, unless the articles of incorporation provide for greater individual liability, a director or officer is not individually liable to the corporation or its stockholders for any damages as a result of any act or failure to act in his capacity as a director or officer unless it is proven that: (a) his act or failure to act constituted a breach of his fiduciary duties as a director or officer; and (b) his breach of those duties involved intentional misconduct, fraud or a knowing violation of law. |

| | |

| Indemnification | | |

| | |

Under the DGCL, a corporation may indemnify current or former directors, unanimously recommendsofficers, employees or agents against reasonable expenses, attorney’s fees, fines, judgments, and settlements incurred in actions brought against them in their capacity as such, so long as they acted in good faith and under the reasonable belief that their actions were not opposed to the Company’s stockholders vote FORbest interests of the corporation and were lawful. However, to the extent a person is found liable to the corporation in such an action, the corporation may only indemnify that person upon approval of the Dakota Gold 2022 Stock Incentive Plan.court where the action was brought. Additionally, a corporation can advance defense and expenses after the receiving individual agrees to repay the corporation if such person is ultimately determined not to be entitled to indemnification. BackgroundThe Delaware Certificate of Incorporation and ReasonsDelaware Bylaws provide for Adoptingindemnification of directors and officers to the 2022 Stock Planfullest extent permitted by the DGCL.

| | Under the NRS, a corporation may indemnify current or former directors, officers, employees or agents against expenses, including attorney’s fees, judgments, fines, and amounts paid in settlement actually and reasonably incurred by the person in connection with the action, suit or proceeding if the person acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the conduct was unlawful. The corporation may also identify such individuals in actions by or in the right of the corporation to procure a judgment in its favor. A corporation can advance expenses after the receiving individual agrees to repay the corporation if such person is ultimately determined not to be entitled to indemnification. On March 30, 2022,In derivative suits, a corporation may indemnify its agents for expenses that the Boardperson actually and reasonably incurred. A corporation may not indemnify a person if the person was adjudged to be liable to the corporation unless a court otherwise orders.

No corporation may indemnify a party unless it determines, through its stockholders, directors or independent counsel, that the indemnification is proper. |

| | |

Expiration of Directors approved the Dakota Gold Corp. 2022 Stock Incentive Plan (the “2022 Stock Plan”). The purposeProxies | | |

| | |

Section 212 of the 2022 Stock PlanDGCL provides that the appointment of a proxy with no expiration date may be valid for up to 3 years, but that a proxy may be provided for a longer period. Furthermore, a duly executed proxy may be irrevocable if it states that it is to fosterirrevocable and promote the long-term financial success of the Company and materially increase shareholder value by (a) motivating superior performance by means of performance-related incentives, (b) encouraging and providing for the acquisition ofif, it is coupled with an ownership interest in the Company by Employees, Non-Employee Directors and Third Party Service Providers (as defined therein), and (c) enablingstock itself or an interest in the Companycorporation generally, sufficient in law to attract and retain qualified and competent persons to serve as members ofsupport an outstanding management team and the Board of Directorsirrevocable power. | | Section 78.355(4) of the Company upon whose judgment,NRS provides that proxies may not be valid for more than 6 months, unless the proxy is irrevocable due to being coupled with an interest and performance are requiredor the stockholder specifies that the proxy is to continue in force for the successful and sustained operations of the Company.The following discussion and summary of the material terms of the 2022 Stock Plan is qualified in its entirety by reference to the full text of the 2022 Stock Plan, a form of which is set forth in Appendix A to this proxy statement.

Key Features of the 2022 Stock Plan

The following features of the 2022 Stock Plan reflect the equity incentive plan “best practices” intended to protect the interests of our stockholders:

A fixed reserve of 6,250,000 shares of common stock that are authorized for issuance pursuant to plan awards;

No “evergreen” increase to the share reserve;

A ten (10) year term that expires on August 22, 2032;

Permitted awards include options, stock appreciation rights (“SARs”), restricted stock, restricted stock units (“RSUs”), performance shares, performance units (“PSUs”), and other cash and stock-based awards;

No direct or indirect repricing of options or SARs without shareholder approval; and

Dividend equivalents on unvested awards subject to performance vesting are accrued and paid only if related awards vest.

Shares Available for Issuance under the 2022 Stock Plan

The number of shares reserved for issuance under the 2022 Stock Plan is 6,250,000. The Board determined the share reserve based on the Company’s current stage of development and the burn rate of peer companies. The Company has authorized specific grants of awards to be made under the 2022 Stock Plan and such awards will be granted following stockholder approval of the 2022 Stock Plan at the 2022 annual meeting of stockholders.

longer period. |

| Shareholder Meeting Quorum Requirements | | |

| | |

The 2022 Stock Plan does not setSection 216 of the DGCL provides that the certificate of incorporation or bylaws of any corporation authorized to issue stock may specify the number of shares subjecthaving voting power and the number of such shares that must be present or represented by proxy at any meeting in order to equity awards that will be granted in future years. In setting each year’s award amounts for executive officers, the Compensation Committee considersconstitute a varietyquorum, however, a quorum may not consist of factors such as: the relative market positionless than one-third of the awards, the proportion of each executive’s total compensationshares entitled to be delivered as a long-term incentive award, internal pay equity, executive performance, retention concerns, and the Company’s performance. Similar considerations are taken into account in granting awards to participants who are not executive officers.

To reduce the dilutive impact of our equity award grants on our stockholders’ interests, equity awards are generally limited to individuals whose personal performance makes them highly valuable to us and essential new hires.

New Plan Benefits

No awards have yet been granted under the 2022 Stock Plan, as it will only take effect upon stockholder approvalvote at the 2022 annual meeting of stockholders, however, the Company has authorized certain grants of awards to be made following and subject to stockholder approval of the 2022 Stock Plan, as shown in the following table.meeting.

2022 Stock Plan

| Name and Position | | Dollar Value

($) | | | Number of Units(1) | | Jonathan Awde, Chief Executive Officer | | $ | 400,000 | | | 25% restricted share units; 25% performance share units; and 50% options(2) | | Shawn Campbell, Chief Financial Officer | | $ | 250,000 | | | 25% restricted share units; 25% performance share units; and 50% options(2) | | Gerald Aberle, Chief Operating Officer | | $ | 350,000 | | | 25% restricted share units; 25% performance share units; and 50% options(2) | | James Berry, Vice President of Exploration | | $ | 350,000 | | | 25% restricted share units; 25% performance share units; and 50% options(2) | | Executive Group | | | | | | | | Non-Executive Director Group | | $ | 200,000 | | | 100% restricted share units(3) | | Non-Executive Officer Employee Group | | $ | 727,250 | | | 100% restricted share units(4) |

(1) | The number of units will be determined based on the fair market value of the Company’s common stock at the time of the grant. | (2) | Restricted share units vest 1/3 annually over three years from the date of grant; performance share units vest 1/3 annually from the time of grant and pay out 50% of their value to a maximum of 200% of their value based on the value of the Company’s shares over each applicable performance period, measured against the MVIS Global Junior Gold Miners Index (MVGDXJ); and stock options will vest 1/3 annually over three years and expire five years from the date of grant. | (3) | Restricted share units vest will vest one year from the date of grant. | (4) | Restricted share units vest 1/3 annually over three years from the date of grant. |

Description of the 2022 Stock Plan

The following summary of the material terms of the 2022 Stock Plan is qualified in its entirety by reference to the full text of the 2022 Stock Plan, a form of which is set forth in Appendix A to this Proxy Statement. Purpose of the 2022 Plan

The purpose of the 2022 Stock Plan is to foster and promote the long-term financial success of the Company and materially increase shareholder value by providing an additional means for the Company to attract, motivate, retain and reward directors, officers, employees and certain independent consultants.

Administration

The Compensation Committee will administer the 2022 Stock Plan. Except where prohibited by applicable law, the Compensation Committee may delegate some or all of its administrative duties or powers with respect to the 2022 Stock Plan to one or more of its members or to one or more officers of the Company or any subsidiary or to one or more agents or advisors. For purposes of Rule 16b-3 of the Exchange Act and for grants to non-employee directors, the 2022 Stock Plan must be administered by a committee consisting solely of two or more independent directors. The appropriate acting body, be it the Compensation Committee, a member thereof or an officer within his or her delegated authority, is referred to in this proposal as the “Administrator.”

The Administrator has broad authority under the 2022 Stock Plan with respect to award grants, including, without limitation, the authority:

To select participants and determine the type(s) of award(s) that they are to receive;

To determine the number of shares that are to be subject to awards and the terms and conditions of awards, including the price (if any) to be paid for the shares or the award;

Subject to the other provisions of the 2022 Stock Plan, to make certain adjustments to outstanding awards and authorize the conversion, succession or substitution of awards; and

To allow the purchase price of awards or shares of common stock to be paid in the form of cash or its equivalent, by the delivery of already-owned shares of common stock or by a reduction of the number of shares deliverable pursuant to the awards, by cashless exercise, on such terms as the Administrator may authorize, or any other form permitted by law.

Eligibility

Persons eligible to receive awards under the 2022 Stock Plan include officers and employees of the Company or any of its subsidiaries and non-employee directors of the Company, as well as certain independent contractors who render bona fide services to the Company or one of its subsidiaries. As of July 22, 2022, there were 11 employees (including officers) and 0 consultants of the Company and its subsidiaries, and five non-employee directors of the Company who would potentially be eligible to receive awards under the 2022 Stock Plan.

Authorized Shares

The 2022 Stock Plan authorizes the issuance of up to 6,250,000 shares of common stock pursuant to plan awards.

Shares that are subject to or underlie awards that expire or for any reason are canceled or terminated, are forfeited, fail to vest, or for any other reason are not paid or delivered under the 2022 Stock Plan are available for reissuance under the 2022 Stock Plan. In addition, shares tendered or withheld to satisfy the exercise price of options or tax withholding obligations, and shares covering the portion of exercised share-settled SARs that were not issued upon the exercise of such SAR, are available for reissuance under the 2022 Stock Plan.

No Repricing

In no event will any adjustment be made to a stock option or SAR under the 2022 Stock Plan (by amendment, cancellation and regrant, exchange for other awards or cash or other means) that would constitute a repricing of the per share exercise or base price of the award, unless such adjustment is approved by the shareholders of the Company. Adjustments made in accordance with the 2022 Stock Plan to reflect a stock split or similar event are not deemed to be a repricing.

Dividends and Dividend Equivalents

Unless otherwise determined by the Compensation Committee, dividends accrue on unvested shares of restricted stock, providedDelaware Bylaws provides that the Compensation Committee may require that any dividends on such sharesholders of restricted stock be automatically deferred and reinvested in additional restricted stock subject to the same restrictions on vesting as the underlying award, or may require that dividends or other distributions on restricted stock be paid to the Company for the account of the participant and held pending vesting of the underlying award. Accrued dividend-equivalent amounts with respect to awards subject to performance vesting shall not be paid unless and until such awards to which they relate become vested.

Types of Awards

The 2022 Stock Plan authorizes stock options, SARs, restricted stock, RSUs, performance units, performance shares (“PSUs”one-third (33 1/3%), and other forms of awards that may be granted or denominated in or otherwise determined by reference to the shares of common stock of the Company, as well as cash awards. The 2022 Stock Plan provides flexibility to offer competitive incentives and to tailor benefits to specific needs and circumstances. Awards may, in certain cases, be paid or settled in cash.

Stock Options

A stock option is a right to purchase shares of common stock at a future date at a specified price per share (the “exercise price”). The per share exercise price of an option generally may not be less than the fair market value of a share of common

stock on the date of grant. On July 22, 2022, the last sale price of the shares of our common stock as reported on the NYSE American was $3.78 per share. The maximum term of an option is ten years from the date of grant. An option may be either an incentive stock option oroutstanding and entitled to vote will constitute a nonqualified stock option. Incentive stock options are taxed differently than nonqualified stock options and are subject to more restrictive terms under the Internal Revenue Code of 1986, as amended (the “Code”), and the 2022 Stock Plan. Incentive stock options may be granted only to employeesquorum.

| | Section 78.320(1)(a) of the CompanyNRS provides that unless the articles of incorporation or bylaws provide for different proportions, a subsidiary thereof.majority of the voting power of the common stock constitutes a quorum for the transaction of business. SARs

A SAR is the right to receive payment of an amount equal to the excess of the fair market value of a share of common stock on the date of exercise of the SAR over the base price of the SAR. The base price is established by the Administrator at the time of grant of the SAR and may not be less than the fair market value of a share of common stock on the date of grant. SARs may be granted in connection with other awards or independently. The maximum term of a SAR is ten years from the date of grant.

Restricted Stock

Shares of restricted stock are shares of the Company’s common stock that are subject to forfeiture and to certain restrictions on sale, pledge, or other transfer by the recipient during a particular period of employment or service or until certain performance vesting conditions are satisfied. Subject to the restrictions provided in the applicable award agreement and the 2022 Stock Plan, a participant receiving restricted stock may have all of the rights of a stockholder as to such shares, including the right to vote and the right to receive dividends; provided, however,current bylaws provide that the Compensation Committee may require that any dividends on such sharesholders of restricted stock be automatically deferred and reinvested in additional restricted stock subject to the same restrictions on vesting as the underlying award, or may require that dividends or other distributions on restricted stock be paid to the Company for the account of the participant and held pending vesting of the underlying award.

RSUs

An RSU represents the right to receive one share of common stock on a specific future vesting or payment date. Subject to the restrictions provided in the applicable award agreement and the 2022 Stock Plan, a participant receiving RSUs has no rights as a shareholder with respect to the RSUs until the shares of common stock are issued to the participant. RSUs may be granted with dividend-equivalent rights that are payable only if the underlying RSUs vest. RSUs may be settled in cash if so provided in the applicable award agreement.

Performance Units

A performance unit is a performance-based award that has an initial notional value equal to a dollar amount determined by the Compensation Committee. The number of performance units earned is determined based on the attainment of one or more performance goals set forth in the award agreement over a specified performance period. Earned performance units (if any), may be settled in the form or cash, shares of common stock, or a combination thereof at the end of the applicable performance period.

PSUs

A PSU is a performance-based award that entitles the recipient to receive shares of common stock based on attainment of one or more performance goals. Each PSU shall designate a target number of shares payable under the award, with the actual number of shares earned (if any) based on a formula set forth in the award agreement related to the attainment of one or more performance goals. A participant receiving PSUs has no rights as a shareholder until the shares of common stock are issued to the participant. PSUs may be granted with dividend-equivalent rights that are payable only if the underlying PSUs are earned. PSUs may be settled in cash if so provided in the applicable award agreement.

Cash Awards

The Administrator, in its sole discretion, may grant cash awards, including, without limitation, discretionary awards, awards based on objective or subjective performance criteria, and awards subject to other vesting criteria.

Other Awards

The other types of awards that may be granted under the 2022 Stock Plan include, without limitation, the grant or offer for sale of unrestricted shares of common stock and the grant of deferred shares of common stock or deferred share units, and similar securities with a value derived from the value of, or related to, the shares of common stock or returns thereon.

Other Terms

Change of Control

In the event of a change in control, unless otherwise determined by the Compensation Committee, (a) all outstanding options and SARs will immediately become fully vested (and, to the extent applicable, all performance conditions shall be deemed satisfied) and exercisable, (b) all other awards subject to time vesting will immediately become fully vested and will be settled in cash, shares of common stock or a combination thereof as soon as practicable following such change in control, (c) all other awards, other than options and SARs, that are subject to performance vesting will immediately vest and all performance conditions will be deemed satisfied as if target performance was achieved, and will be settled in cash, shares of common stock or a combination thereof as soon as practicable following such change in control, and (d) the treatment of other awards that do not vest pursuant to (a), (b) or (c) above will be determined in accordance with the applicable award agreement or, if not specified in the award agreement, will be determined by the Compensation Committee.

Transferability of Awards

Awards under the 2022 Stock Plan generally are not transferable by the recipient other than by will or the laws of descent and distribution, or pursuant to domestic relations orders. Awards with exercise features are generally exercisable during the recipient’s lifetime only by the recipient. Any amounts payable or shares issuable pursuant to an award generally will be paid only to the recipient or the recipient’s beneficiary or representative. The Administrator has discretion, however, to establish written conditions and procedures for the transfer of awards to other persons or entities, as long as such transfers comply with applicable federal, state and provincial securities laws and provided that any such transfers are not for consideration.

Adjustments

As is customary in plans of this nature, the share limits and the number and kind of shares available under the 2022 Stock Plan and any outstanding awards, as well as the exercise or purchase prices of awards, are subject to adjustment in the event of certain reorganizations, mergers, combinations, recapitalizations, stock splits, stock dividends, or other similar events that change the number or kind of shares outstanding, and extraordinary dividends or distributions of property to the shareholders.

No Limit on Other Authority

The 2022 Stock Plan does not limit the authority of the Board or any committee thereof to grant awards or authorize any other compensation, with or without reference to the shares of common stock of the Company, under any other plan or authority.

Termination of, or Changes to, the 2022 Stock Plan

The Board may amend or terminate the 2022 Stock Plan at any time and in any manner. Shareholder approval for an amendment will be required only to the extent then required by applicable law or any applicable stock exchange rules, or as required to preserve the intended tax consequences of the 2022 Stock Plan. For example, shareholder approval is required for any proposed amendment to increase the maximum number of shares that may be delivered with respect to awards granted under the 2022 Stock Plan. Adjustments as a result of stock splits or similar events will not, however, be considered amendments requiring shareholder approval. Unless terminated earlier by the Board, the authority to grant new awards under the 2022 Stock Plan will terminate ten years after the date on which the 2022 Stock Plan was approved by the Board. Outstanding awards will generally continue following the expiration or termination of the 2022 Stock Plan. Generally speaking, outstanding awards may be amended by the Board (except for a repricing), but the consent of the award holder is required if the amendment (or any plan amendment) materially and adversely affects the award holder.

Certain Federal Income Tax Consequences

The following summary of the United States federal income tax consequences of awards under the 2022 Stock Plan is based upon U.S. federal income tax laws in effect on the date of this Proxy Statement. This summary does not purport to be complete, and does not discuss state, local or non-U.S. tax consequences. The tax consequences of individual awards may vary depending upon the particular circumstances applicable to any individual participant.

Nonqualified Stock Options

The grant of a nonqualified stock option under the 2022 Stock Plan will not result in any federal income tax consequences to the participant or to the Company. Upon exercise of a nonqualified stock option, the participant will recognize ordinary compensation income equal to the excess of the fair market valueone-third (33 1/3%) of the shares of our common stock of the Company at the time of exercise over the option exercise price. If the participant is an employee, this income is subject to withholding for federal incomeoutstanding and employment tax purposes. The Company is entitled to an income tax deduction invote will constitute a quorum.

|

| | |

| Shareholder Voting Requirements | | |

| | |

Under the amountDGCL, the bylaws or certificate of incorporation may set the income recognizedpercentage vote required for any specific action by the participant, subject to possible limitations imposed by the Code, including Section 162(m) thereof. Any gain or loss on the participant’s subsequent disposition of the shares will be treated as long-term or short-term capital gain or loss, depending on the sales proceeds received and whether the shares are held for more than one year following exercise. The Company does not receive a tax deduction for any subsequent capital gain.Incentive Stock Options

The grant of an incentive stock option (or “ISO”) under the 2022 Stock Plan will not result in any federal income tax consequences to the participant or to the Company. A participant recognizes no federal taxable income upon exercising an ISO (subject to the alternative minimum tax rules discussed below), and the Company receives no deduction at the time of exercise.stockholders. In the event of a disposition of shares acquired upon exercise of an ISO, the tax consequences depend upon how long the participant has held the shares. If the participant does not dispose of the shares within two years after the ISO was granted, nor within one year after the ISO was exercised, the participant will recognize a long-term capital gain (or loss) equal to the difference between the sale price of the shares and the exercise price. The Company is not entitled to any deduction under these circumstances.

If the participant fails to satisfy either of the foregoing holding periods (referred to as a “disqualifying disposition”), he or she will recognize ordinary compensation income in the year of the disposition. The amount of ordinary compensation income generally is the lesser of (i) the difference between the amount realized on the disposition and the exercise price or (ii) the difference between the fair market value of the shares at the time of exercise and the exercise price. Such amount is not subject to withholding for federal income and employment tax purposes, even if the participant is an employee of the Company. Any gain in excess of the amount taxed as ordinary income will generally be treated as a short-term capital gain. The Company, in the year of the disqualifying disposition, is entitled to a deduction equal to the amount of ordinary compensation income recognized by the participant, subject to possible limitations imposed by the Code, including Section 162(m) thereof.

The “spread” under an ISO (i.e., the difference between the fair market value of the shares at exercise and the exercise price) is classified as an item of adjustment in the year of exercise for purposes of the alternative minimum tax. If a participant’s alternative minimum tax liability exceeds such participant’s regular income tax liability, the participant will owe the alternative minimum tax liability.

Restricted Stock

Restricted stock is generally taxable to the participant as ordinary compensation income on the date that the restrictions lapse (i.e., the date that the stock vests), in an amount equal to the excess of the fair market value of the shares on such date over the amount paid for such stock, if any. If the participant is an employee, this income is subject to withholding for federal income and employment tax purposes. The Company is entitled to an income tax deduction in the amount of the ordinary income recognized by the participant, subject to possible limitations imposed by the Code, including Section 162(m) thereof. Any gain or loss on the participant’s subsequent disposition of the shares will be treated as long-term or short-term capital gain or loss depending on the sales price and how long the stock has been held since the restrictions lapsed. The Company does not receive a tax deduction for any subsequent gain.

Participants receiving restricted stock awards may make an election under Section 83(b) of the Code (a “Section 83(b) Election”) to recognize as ordinary compensation income in the year that such restricted stock is granted in an amount equal to the excess of the fair market value on the date of the issuance of the stock over the amount paid for such stock. If the participant is an employee, this income is subject to withholding for federal income and employment tax purposes. If such an election is made, the recipient recognizes no further amounts of compensation income upon the lapse of any restrictions and any gain or loss on subsequent disposition will be long-term or short-term capital gain or loss to the recipient. However, if the stock is later forfeited, the participant will not be able to recover the tax previously paid pursuant to the Section 83(b) Election. The Section 83(b) Election must be made within 30 days from the time the restricted stock is issued. The Company is entitled to a deduction equal to the amount of income taken into account as a result of the Section 83(b) Election, subject to possible limitations imposed by the Code, including Section 162(m) thereof.

To the extent dividends are paid while the restrictions on the stock are in effect, any such dividends will be taxable to the participant as ordinary income (and will be treated as additional wages for federal income and employment tax withholding purposes, if the recipient is an employee) and will be deductible by the Company (subject to possible limitations imposed by the Code, including Section 162(m) thereof), unless the participant has made a Section 83(b) Election, in which case the dividends will generally be taxed at dividend rates and will not be deductible by the Company.

Other Awards

Other awards (such as RSUs and PSUs) are generally treated as ordinary compensation income as and when shares of common stock or cash are paid to the participant upon vesting or settlementabsence of such awards. Ifa provision, the participant is an employee, this income is subject to withholding for income and employment tax purposes. The Company is generally entitled to an income tax deduction equal to the amount of ordinary income recognizedstockholders may approve corporate actions by the recipient, subject to possible limitations imposed by the Code, including Section 162(m) thereof.

Section 162(m) of the Internal Revenue Code

Under Code Section 162(m), no deduction is generally allowed in any taxable year of the Company for compensation in excess of $1 million paid to any of the Company’s “covered employees.” A “covered employee” is any individual who has served at any time after December 31, 2016 as the Company’s chief executive officer, chief financial officer, or other executive officer whose compensation has been reported in a Company proxy statement, regardless of whether any such individual is still employed by the Company. The Company may be prohibited under Code Section 162(m) from deducting compensation paid pursuant to the 2022 Stock Plan to our “covered employees.”

Section 409A of the Internal Revenue Code

Section 409A of the Code provides certain requirements for the deferral and payment of deferred compensation arrangements. In the event that any award under the 2022 Stock Plan is deemed to be a deferred compensation arrangement, and if such arrangement does not comply with Section 409A of the Code, the recipient of such award will recognize ordinary income once such award is vested, as opposed to at the time or times set forth above. In addition, the amount taxable will be subject to an additional 20% federal income tax along with other potential taxes and penalties. It is intended, although not guaranteed, that all awards issued under the 2022 Stock Plan will either be exempt from or compliant with the requirements of Section 409A of the Code.

Interested Parties

Approval of the 2022 Stock Plan will change the number of shares available for issuance to the directors and executive officers of the Company, thus each of those persons has an interest in and will be affected from the approval of the 2022 Stock Plan.

Vote Required and Recommendation

The affirmative vote of a majority of those shares represented at the meeting and elect directors by a plurality.

| | Unless provided otherwise under the NRS, the articles of incorporation or the bylaws, action by the stockholders of a Nevada corporation on a matter other than the election of directors is approved if the number of votes cast for this proposal is required to approvein favor of the 2022 Stock Plan. Abstentions will haveaction exceeds the effectnumber of a vote “against” the 2022 Stock Plan. Broker non-votes will not be counted as either votes cast forin opposition to the action. |

| | |

| Amendment to the Bylaws | | |

| | |

Delaware law provides that the stockholders may amend or against this proposal. The Board recommends that shareholdersrepeal bylaws at any annual or special meeting where a quorum is present, by a majority vote “FOR”of those shares present (or by a supermajority vote if required by the adoption and approvalcertificate of incorporation or current bylaws), unless the 2022 Stock Plan.

THE BOARD AND ITS COMMITTEES |

Board Leadership Structure and Risk Oversightcertificate of incorporation confers such power on the board of directors, although the power vested in the stockholders is not divested or limited where the board of directors also has such power.

Our CEO and Co-Chairmen roles are separate. The board has not reached a formal policy on separationDelaware Certificate of the roles of CEO and Chairman and will periodically review the leadership structure to determine appropriateness. Drs. Quartermain and O’Rourke, our Co-Chairmen, bring significant experience in the mining and natural resource industries, serving in various executive and board positions. In their capacity as Co-Chairmen, both work closely with Mr. Awde, the Chief Executive Officer.

Companies such as ours face a variety of risks, including financial reporting, legal, credit, liquidity, operational, health, safety and cybersecurity. The Board of Directors believes an effective risk management system will (1) identify the material risksIncorporation provides that we face in a timely manner, (2) communicate necessary information with respect to material risks to senior executives and to the Board of Directors is expressly authorized and empowered to adopt, amend, alter, or relevantrepeal the Bylaws without any action on the part of the stockholders.

| | Nevada law provides that, unless otherwise prohibited by any bylaws adopted by the stockholders, the board committee, (3) implementof directors may amend any bylaw, including any bylaw adopted by the stockholders. The articles of incorporation may grant the authority to adopt, amend or oversee implementationrepeal bylaws exclusively to the directors. |

| | |

Amendment to the Certificate of appropriateIncorporation | | |

| | |

Section 242(b) of the DGCL provides that the stockholders must approve most amendments to the corporation’s certificate of incorporation adopted by the board of directors at a special or annual meeting by a majority vote (or by a supermajority vote if required by the certificate of incorporation) of those shares entitled to vote on such matter. Unless required by the certification of incorporation, the DGCL exempts a name change or deletion of certain provisions of a certificate of incorporation from the requirement of stockholder approval. Additionally, Section 242(d) provides that amendments for reverse stock splits and responsive risk managementto increase or decrease to the number of authorized shares of a class of stock may be approved by majority of votes cast (unless the certificate of incorporation expressly elects to maintain a “majority of the shares outstanding” voting standard under Section 242(b)) if the class of stock in question is listed on a national exchange immediately before the amendment becomes effective and mitigation strategies consistent with our risk profile,the affected class of stock continues to meet the listing requirements of the applicable national securities exchange regarding any minimum number of holders after giving effect to such amendment. A Delaware corporation need not solicit stockholder votes to amend its certificate of incorporation to effectuate a forward stock split and (4) integrate risk managementproportionately increase its authorized shares, so long as the corporation has only one class of stock outstanding and it is not divided into our decision-making.series. The BoardDelaware Certificate of Directors oversees risk managementIncorporation follows the default voting standards permitted by Section 242(d). | | Nevada law provides that the articles of incorporation may be amended after receiving briefingsthe board of directors adopt a resolution setting forth the amendment and a majority of the stockholders approve such amendment. However, stockholder approval is not required for a change in the corporation’s name unless the articles of incorporation provide otherwise. |

| Stockholder Inspection Rights | | |

| | |

Under Delaware law, any stockholder or beneficial owner of shares may, upon written demand under oath stating the proper purpose thereof and during usual business hours, either in person or by attorney, inspect and make copies and extracts from managementa corporation’s stock ledger, list of stockholders and advisorsits other books and basedrecords for any proper purpose. The burden of proving a proper purpose is on its own analysis and conclusions regarding the adequacy of our risk management processes. The Board of Directors, with assistance and input from its committees, continuously evaluates and manages material risks, including geopolitical and enterprise risk, financial risk, environmental risk, health and safety risk, andstockholder who seeks to inspect corporate records; however, the effect of compensation structures on risk-taking behaviors. The Board of Directors’ committees are an integral part of its oversight of risk management. As examples, the Board of Directors assesses the Company’s safety culture and related risks; the Audit Committee assesses and manages the Company’s exposure to enterprise-level risks, as well as the Company’s major financial risk exposure; the Compensation Committee assess risksstated judicial standard is a purpose reasonably related to an interest as a stockholder. | | Under Nevada law, any person who has been a stockholder of record for at least six months or holds at least 5% of all outstanding shares shall have the performanceright to examine, in person or by agent, a copy of the Company’s executive officers;corporation’s articles of incorporation (and all amendments and bylaws) and stock ledger. The Nevada corporation may require the ESG Committee and Technical Committee assess environmental and social risks.By virtuestockholder to furnish an affidavit that the inspection is not desired for a purpose which is in the interest of a business or object other than the business of the directors working closely with executive management, whocorporation.

|

| | |

| Interested Stockholder Combinations | | |

| | |

Delaware has a business combination statute, set forth in turn work closely with Company’s employees and contractors, we believe we have created an effective and efficient risk communication system that enables collaboration and communication. MeetingsSection 203 of the BoardDGCL, which provides that any person who acquires 15% or more of Directors

The currenta corporation’s voting stock (thereby becoming an “interested stockholder”) may not engage in certain “business combinations” with the target corporation for a period of 3 years following the time the person became an interested stockholder, unless (i) the board of directors of the Company was appointed on March 31, 2022. Since March 31, 2022, our boardcorporation has approved, prior to the interested stockholder’s acquisition of stock, either the business combination or the transaction that resulted in the person becoming an interested stockholder, (ii) upon consummation of the transaction that resulted in the person becoming an interested stockholder, that person owns at least 85% of the corporation’s voting stock outstanding at the time the transaction is commenced (excluding shares owned by persons who are both directors held one meeting. Each incumbent director attended all meetings ofand officers and shares owned by employee stock plans in which participants do not have the right to determine confidentially whether shares will be tendered in a tender or exchange offer), or (iii) the business combination is approved by the board of directors and committeesauthorized by the affirmative vote (at an annual or special meeting and not by written consent) of at least two-thirds of the outstanding voting stock not owned by the interested stockholder.

| | Section 78.438 of the NRS prohibits a Nevada corporation from engaging in any business combination with any interested stockholder (any entity or person beneficially owning, directly or indirectly, 10% or more of the outstanding voting stock of the corporation and any entity or person affiliated with or controlling or controlled by any of these entities or persons) for a period of 3 years following the date that the stockholder became an interested stockholder, unless prior to that date, the board of directors onof the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder. Section 78.439 provides that business combinations after the 2-year period following the date that the stockholder becomes an interested stockholder may also be prohibited unless approved by the corporation’s directors or other stockholders or unless the price and terms of the transaction meet the criteria set forth in the statute. |

For purposes of determining whether a person is the “owner” of 15% or more of a corporation’s voting stock for purposes of Section 203 of the DGCL, ownership is defined broadly to include the right, directly or indirectly, to acquire the stock or to control the voting or disposition of the stock. A business combination is also defined broadly to include (i) mergers or consolidations of the corporation or its subsidiaries with or caused by the interested stockholder, (ii) sales or other dispositions of 10% or more of the assets of a corporation with or to an interested stockholder, (iii) certain transactions resulting in the issuance or transfer to the interested stockholder of any stock of the corporation or its subsidiaries, (iv) certain transactions which hewould result in increasing the proportionate share of the stock of a corporation or she served. All directors hold office until hisits subsidiaries owned by the interested stockholder, and (v) receipt by the interested stockholder of the benefit (except proportionately as a stockholder) of any loans, advances, guarantees, pledges or her successor is elected or until his or her earlier death, resignation or removal.other financial benefits. CommitteesThese restrictions placed on interested stockholders by Section 203 of the Board & Director IndependenceDGCL do not apply under certain circumstances, including, but not limited to, the following: (i) if the corporation’s original certificate of incorporation contains a provision expressly electing not to be governed by Section 203, (ii) if the corporation, by action of its stockholders, adopts an amendment to its bylaws or certificate of incorporation expressly electing not to be governed by Section 203, provided that such an amendment is approved by the affirmative vote of not less than a majority of the outstanding shares entitled to vote and that such an amendment will not be effective until 12 months after its adoption (except for limited circumstances where effectiveness will occur immediately) and will not apply to any business combination with a person who became an interested stockholder at or prior to such adoption.

Our boardThe Delaware Certificate of Incorporation does not include an election to not be governed by Section 203.

| | |

| | |

| Advance Notice Provisions | | |

| | |

Delaware law permits a corporation to include in its bylaws provisions requiring advance notice of shareholder proposals. The Delaware Bylaws will provide that advance notice of a stockholder’s proposal or director nominee must be delivered to the Secretary at the Company’s principal executive offices not less than ninety (90) days nor more than one hundred and twenty (120) days prior to the one-year anniversary of the preceding year’s annual meeting; provided, however, that if the date of the annual meeting is more than thirty (30) days before or more than seventy (70) days after such anniversary date, notice by the stockholder to be timely must be so delivered, or mailed and received, not earlier than the one hundred twentieth (120th) day prior to such annual meeting and not later than the later of (i) the ninetieth (90th) day prior to such annual meeting, or (ii) the tenth (10th) day following the day on which public disclosure of the date of such annual meeting was first made. | | Nevada law permits a corporation to include in its bylaws provisions requiring advance notice of shareholder proposals. The Company’s current Bylaws do not include such an advance notice provision. |

| Selection of Forum | | |

| | |

The Delaware Bylaws contain a provision regarding selection of forum, which provides that unless the Company consents in writing to the selection of an alternative forum, the Delaware Court of Chancery shall, to the fullest extent permitted by law, be the sole and exclusive forum for (a) any derivative action or proceeding brought on behalf of the Company, (b) any action asserting a claim of, or claim based on, breach of a fiduciary duty owed by, or other wrongdoing by, any director, officer, or other employee of the Company to the Company or the Company’s stockholders (including a beneficial owner of stock), (c) any action asserting a claim against the Company arising pursuant to any provision of the DGCL, the Company’s Certificate of Incorporation or these Bylaws, (d) any action to interpret, apply, enforce or determine the validity of the Company’s Certificate of Incorporation or Bylaws, or (e) any action asserting a claim against the Company governed by the internal affairs doctrine, in each case subject to the Court of Chancery having personal jurisdiction over the indispensable parties named as defendants therein. Any person or entity purchasing or otherwise acquiring any interest in any of our securities shall be deemed to have notice of and consented to this provision. These exclusive-forum provisions may limit a stockholder’s ability to bring a claim in a judicial forum of its choosing for disputes with us or our directors, is currently composedofficers, or other employees, which may discourage lawsuits against us and our directors, officers, and other employees. If a court were to find either exclusive-forum provision in our amended and restated bylaws to be inapplicable or unenforceable in an action, we may incur additional costs associated with resolving the dispute in other jurisdictions, which could harm our results of seven directors, fouroperations. | | The Company’s current Articles of which are independent. Incorporation and Bylaws do not contain any provisions governing selection of forum for litigating corporate claims. |

Securities Act Consequences

The shares of the Company’s common stock to be issued in exchange for shares of our common stock are not being registered under the Securities Act of 1933, as amended (the “Securities Act”). In that respect, the Company is relying on Rule 145(a)(2) under the Securities Act, which provides that a conversion that has as its sole purpose a change in a corporation’s domicile does not involve the sale of securities for purposes of the Securities Act. After the Reincorporation, Reincorporated Dakota Gold will be a publicly held company, and it will file with the SEC and provide to its stockholders the same type of information that we have previously filed and provided. Stockholders, whose shares of our common stock are freely tradable before the Reincorporation, will continue to have freely tradable shares of Reincorporated Dakota Gold common stock. In summary, Reincorporated Dakota Gold and its stockholders will be in the same respective positions under the federal securities laws after the Reincorporation as the Company and our stockholders prior to the Reincorporation.

No Exchange of Stock Certificates Required

Stockholders are not required to exchange their stock certificates for new certificates representing shares of Reincorporated Dakota Gold common stock. New stock certificates representing shares of Reincorporated Dakota Gold common stock will not be issued to a stockholder until such stockholder submits one or more existing certificates for transfer, whether pursuant to a sale or other disposition. However, stockholders (at their option and at their expense) may exchange their stock certificates for new certificates representing shares of Reincorporated Dakota Gold common stock following the Effective Time of the Conversion.

| THE BOARD AND ITS COMMITTEES |

Board Leadership Structure and Risk Oversight

Our CEO and Co-Chairmen roles are separate. The Board of Directors has not reached a formal policy on separation of the roles of CEO and Chairman and will periodically review the leadership structure to determine appropriateness. Drs. Quartermain and O’Rourke, our Co-Chairmen, bring significant experience in the mining and natural resource industries, serving in various executive and board positions. In their capacity as Co-Chairmen, both work closely with Mr. Awde, the Chief Executive Officer.

Companies such as ours face a variety of risks, including financial reporting, legal, credit, liquidity, operational, health, safety and cybersecurity. The Board of Directors believes an effective risk management system will (1) identify the material risks that we face in a timely manner, (2) communicate necessary information with respect to material risks to senior executives and to the Board of Directors or relevant board committee, (3) implement or oversee implementation of appropriate and responsive risk management and mitigation strategies consistent with our risk profile, and (4) integrate risk management into our decision-making.

The Board of Directors oversees risk management after receiving briefings from management and advisors and based on its own analysis and conclusions regarding the adequacy of our risk management processes. The Board of Directors, with assistance and input from its committees, continuously evaluates and manages material risks, including geopolitical and enterprise risk, financial risk, environmental risk, health and safety risk, and the effect of compensation structures on risk-taking behaviors. The Board of Directors’ committees are an integral part of its oversight of risk management. As examples, the committees provide the following assistance to the Board of Directors: the Audit Committee assists with the assessment of the Company’s exposure to enterprise-level risks, as well as the Company’s major financial risk exposure; the Compensation Committee assists with the assessment of risks related to the performance of the Company’s executive officers; and the ESG Committee and Technical Committee assist with the assessment of operating, safety culture, environmental and social risks.

By virtue of the Board of Directors working closely with executive management, who in turn work closely with Company’s employees and contractors, we believe we have created an effective and efficient risk communication system that enables collaboration and communication.

Meetings of the Board of Directors

Our Board of Directors held 4 meetings during the fiscal year ended December 31, 2023. Each incumbent director attended all meetings of the Board of Directors and committees of the Board of Directors on which he or she served.All directors hold office until his or her successor is elected or until his or her earlier death, resignation or removal.

Committees of the Board & Director Independence

Our Board of Directors is currently composed of seven directors, five of which are independent as defined by the listing standards of the NYSE American LLC (the “NYSE American”). We believe that our current board leadership structure is appropriate as a majority of our Board of Directors are independent directors.

On March 31, 2022, the Company formed an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee, a Technical Committee and an Environmental, Social and Governance Committee. The following table sets forth the number of meetings held by the Board of Directors and each committee during the fiscal year ended December 31, 2023.

| Board or Committee | | Number of Meetings during

Fiscal Year Ended December 31,

2023 | |

| Board of Directors | | 4 | |

| Audit Committee | | 4 | |

| Compensation Committee | | 3 | |

Nominating and Corporate Governance Committee a | | 2 | |

Technical Committee and an | | 5 | |

Environmental, Social and Governance Committee. The following table sets forth the number of meetings held by the Board of Directors since March 31, 2022 and each committee since the committees were formed on March 31, 2022.

Board or Committee | | Number of MeetingsCommittee | | 4 | | Board of Directors | | 1 | | Audit Committee | | 1 | | Compensation Committee | | 1 | | Nominating and Corporate Governance Committee | | 1 | | Technical Committee | | 1 | | Environmental, Social and Governance Committee | | 0 | |

Audit Committee. Our Audit Committee currently consists of the following members who are all independent under applicable NYSE American listing standards: Ms. Grafton, Ms. Koenig and Mr. Morrison. Mr. Morrison qualifies as an "Audit Committee Financial Expert" as that term is defined in rules promulgated by the SEC. As Mr. Morrison will not be standing for re-election as a director of the Company, the Board of Directors is seeking a candidate with financial expertise. The purpose of the Audit Committee is to provide assistance to the Board of Directors in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, auditing, financial reporting, internal control and legal compliance functions of the Company and its subsidiaries, including, without limitation: (i) assisting the Board of Directors in its oversight of (a) the integrity of the financial statements of the Company, (b) the Company’s compliance with legal and regulatory requirements, (c) the qualifications and independence of the Company’s independent auditor and (d) the performance of the independent auditor; (ii) preparing the audit committee report required pursuant to the rules of the SEC for inclusion in the Company’s annual proxy statement and (iii) performing such further functions as may be consistent with the Audit Committee charter or assigned by applicable law, the Company’s certificate of incorporation or bylaws

|

Audit Committee

Our Audit Committee currently consists of the following members who are all independent under applicable NYSE American listing standards: and Ms. Schroeder (Chair), Ms. Grafton and Ms. Koenig. Ms. Schroeder qualifies as an “Audit Committee Financial Expert” as that term is defined in rules promulgated by the SEC. The purpose of the Audit Committee is to provide assistance to the Board of Directors in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, auditing, financial reporting, internal control and legal compliance functions of the Company and its subsidiaries, including, without limitation: (i) assisting the Board of Directors in its oversight of (a) the integrity of the financial statements of the Company, (b) the Company’s compliance with legal and regulatory requirements, (c) the qualifications and independence of the Company’s independent auditor and (d) the performance of the independent auditor; (ii) preparing the audit committee report required pursuant to the rules of the SEC for inclusion in the Company’s annual proxy statement and (iii) performing such further functions as may be consistent with the Audit Committee charter or assigned by applicable law, the Company’s Articles of Incorporation or Bylaws or the Board of Directors.

The Board of Directors has adopted a written charter for the Audit Committee that may be viewed on Dakota Gold’s website at: https://dakotagoldcorp.com/site/assets/files/8378/audit-committee-charter-2023-05-17.pdf.

The Board of Directors has adopted a written charter for the Audit Committee that may be viewed on Dakota Gold’s website at: https://dakotagoldcorp.com/site/assets/files/8378/audit_committee_charter_2022-03-30.pdf.

Compensation Committee.

Our Compensation Committee currently consists of the following members who are all independent under applicable NYSE American listing standards: Ms. Grafton (Chair), Ms. Koenig and Mr. Morrison.Dr. Quartermain. The purpose of the Compensation Committee is (i) to oversee the Company’s compensation and employee benefit plans and practices, including its executive and director compensation plans, and its incentive-compensation and equity-based plans; (ii) to reviewevaluate annually the performance of the Chief Executive Officer in light of the goals and discuss with managementobjectives of the Company’s executive compensation discussionplans and analysismake recommendations to be included in the Company’s annual proxy statement or annual reportBoard of Directors to determine and approve the Chief Executive Officer’s compensation level based on Form 10-K filed with the SEC;this evaluation; (iii) to prepareretain, in its sole discretion, a compensation consultant, legal counsel or other adviser and evaluate the Compensation Committee Report as required by the rulesperformance and advice of the SEC;such compensation consultant, legal counsel or other adviser; and (iv) to perform such further functions as may be consistent with the Compensation Committee charter or assigned by applicable law, the Company’s bylawsBylaws or the Board of Directors. In performing its functions, the Compensation Committee considers, among other things, the Company’s performance and relative stockholder return, the value of similar awardscompensation paid to executive officers of comparable companies, and the awards given to the executive officersperformance of the Company in past years.Company’s executive officers.

The Board of Directors has adopted a written charter for the Compensation Committee that may be viewed on Dakota Gold’s website at: https://dakotagoldcorp.com/site/assets/files/8118/compensation_committee_charter_2022-03-30.pdfcompensation-committee-charter-2023-05-17.pdf.

Nominating and Corporate Governance Committee.

Our Nominating and Corporate Governance Committee currently consists of the following members who are all independent under applicable NYSE American listing standards: Ms. Koenig (Chair), Ms. Grafton and Ms. Koenig and Mr. Morrison.Schroeder. The purpose of the Nominating and Corporate Governance Committee is (i) to identify and to recommend to the Board of Directors individuals qualified to serve as directors of the Company and on committees of the Board of Directors; (ii) to advise the Board of Directors with respect to the Board of Directors composition, procedures and committees; (iii) to develop and recommend to the Board of Directors a set of corporate governance principles applicable to the Company and (iv) to oversee the evaluation of the Board of Directors and management of the Company. The Nominating and Corporate Governance Committee considers candidates that possess a variety of skill sets that complement the skills that are represented by the composition of the boardBoard of Directors at any given point in time, including diversity, strategic managerial and financial skills and experience, mining industry expertise, and knowledge in other areas that are strategically important to us. Other considerations include diversity, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest and such other relevant factors that the Committee considers appropriate in the context of the needs of the Board of Directors.